- #How Much Is Quickbooks Point Of Sale How To Accept Payments

- #How Much Is Quickbooks Point Of Sale Software Platform And

How Much Is Quickbooks Point Of Sale Software Platform And

It’s organized by each software platform and type of fee that you incur when using QuickBooks Payments. You also get the QuickBooks Online Backup Service 1 to protect your QuickBooks Point of Sale data and other important business information.This article covers fees and costs for QuickBooks Online (QBO), QuickBooks Desktop (QBDT), and QBO Point of Sale users in the United States. Access technical support experts who can answer all your QuickBooks and QuickBooks Point of Sale questions quickly and cost-effectively. Intuit QuickBooks Point of Sale Support Plan with Online Backup Service. While useful, you do not have to enter information into any of these fields.If you’re evaluating or currently using QuickBooks as your accounting software, have you considered including fees in your budget? If you use QuickBooks Payments, these fees range from basic subscription fees to credit card processing fees.It offers several plans, which start at 1,200 and have 30-day trials that include access to contactless payments, ecommerce integrations, and.Integrates with QuickBooks products: Does not. Type in or select from drop-down menus the rest of the inventory items details including size, regular price, quantity on hand, state tax, UPC code, vendor, order cost, reorder point, manufacturer and shipping information.

Fees vary by vendor.BOOST YOUR SALES. Instead of using Intuit Merchant Services, you may research and choose a compatible third-party payment processing service connecting to QuickBooks utilizing a payment gateway. See your business at a glance-quick and easy access to. QuickBooks Point of Sale Basic offers tools to help smaller stores easily track sales, inventory and customers. Platform : Windows Vista, Windows XP, Windows 7. Update prices, set discounts, transfer data to QuickBooks Accounting.QuickBooks POS Basic Version 10 w/3 Piece Hardware Bundle OLD VERSION Visit the Intuit Store.

QuickBooks Online Subscription Fees by Pricing PlanQuickBooks Online is SaaS cloud bookkeeping and accounting software for which users pay a monthly subscription fee through a choice of pricing plans. As your company grows, QuickBooks offers upgraded software for up to 25 or 30 users. It’s integrated with LivePlan software to easily add the financial section of startup and small business plans. To calculate your total budget related to QuickBooks costs and fees, start by deciding which product best fits your small business, medium-sized business, or smaller enterprise company needs.Many small businesses start with QuickBooks accounting software. Basic Cost of QuickBooks Online and QuickBooks DesktopAs a financial manager or small business owner, you need to anticipate, research, and plan investments.

QuickBooks Desktop Product NameApril 2020 Intuit Basic QB Purchase PriceUp to 3 – additional per-user prices applyUp to 5 – additional per-user prices applyMore features include: forecasting, industry-specific featuresTemporary discount price starting at $849.10 per year (list price is $1,213 per year) – Contact QuickBooks Desktop sales for a quote applicable to your business.Up to 30,Advanced roles -additional per-user prices applyMore features include: mobile inventory barcode scanning, QuickBooks Priority Circle, enhanced Pick, Pack, & ShipQuickBooks Add-on Fees Related to SoftwarePricing for QuickBooks Online is generally different than pricing for QuickBooks Desktop. These retailers may sell it at a lower price.The following table uses information from the QuickBooks Desktop pricing and features link in the prior paragraph. Both QuickBooks and retailers, including Amazon and Costco, sell QuickBooks Desktop, offering CD or e-delivery for either PC or Mac.

Payroll Core $45/month ($13.50/month discounted rate for first 3 months) + $4 per employee/month QuickBooks Online Payroll (choose one level): QuickBooks Online Bookkeeping Setup Fee (one-time session): $50 April 2020 add-on pricing includes a choice of: QuickBooks OnlineAdd-ons to the basic software cost, including optional set-up help and payroll features, are shown at the same QuickBooks Online pricing plans link.

These totals and the monthly Payments plan that you choose will vary widely by business type and size.Intuit is the parent company of QuickBooks. And estimate the average transaction size in dollars or other currency for your global business. Remote hosting (request a quote from QuickBooks Desktop)To include payments-related transaction fees in your business budget, estimate your average number of transactions per month. Pay employees and e-file taxes (request a quote from QuickBooks Desktop) Unlimited customer support, data backups, and upgrades (request a quote from QuickBooks Desktop)

How Much Is Quickbooks Point Of Sale How To Accept Payments

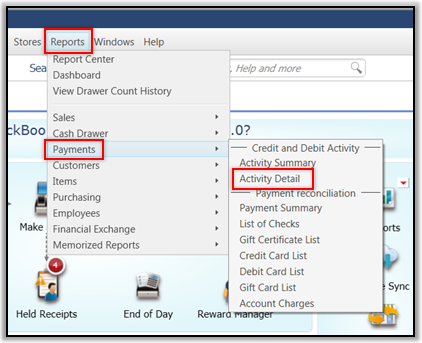

These fees apply to both QuickBooks Online and QuickBooks Desktop users approved for specific Payments program features unless otherwise specified. The linked payment fees schedule was last updated on Ma(see bottom of the page for the latest update date). We explain how to accept payments through QuickBooks in this linked article.Intuit provides a fee summary by type in the Intuit Payments Standard Pricing Schedule , for eligible customers joining on or after May 20, 2019, as part of its Intuit Merchant Agreement. Users apply for Payments through their QuickBooks account.

The Intuit Payments Standard Pricing Schedule also shows pricing for the $20/ month QuickBooks Online Payments plan, which offers a lower percentage rate for transaction processing fees. Quickbooks charges a 2.4% rate for card swiped and a 3.4% rate for card keyed transactions, with both also having a $0.25 fee per transaction.QuickBooks offers this link to current credit card processing fees and terms, which includes QuickBooks Online credit card transaction pricing for “non-monthly” $0 QuickBooks Online Payments plans. Card reader transactions have a lower fee because Quickbooks can instantly verify cardholder info.

Intuit Merchant Services doesn’t charge any set-up fees for credit card processing. Intuit supports PayPal payments for QuickBooks Online only. It allows Apple Pay for both QuickBooks Online and Desktop. Customers with a pricing rate review change may pay non-standard rates.QuickBooks Payments will process credit cards and debit cards, including MasterCard, Visa, American Express, and Discover. Intuit prices credit card transaction fees differently for QuickBooks Desktop. Users may only switch once per 12 months from a non-monthly to a monthly fee Payments plan.

Keyed Credit Card or Debit Card: 3. Invoice, PayPal and Apple Pay: 2.9% of the transaction total + 25 cents per transaction Swiped Credit Card Fees or Debit Card Fees: 2.4% of the transaction total + 25 cents per transaction

0 kommentar(er)

0 kommentar(er)